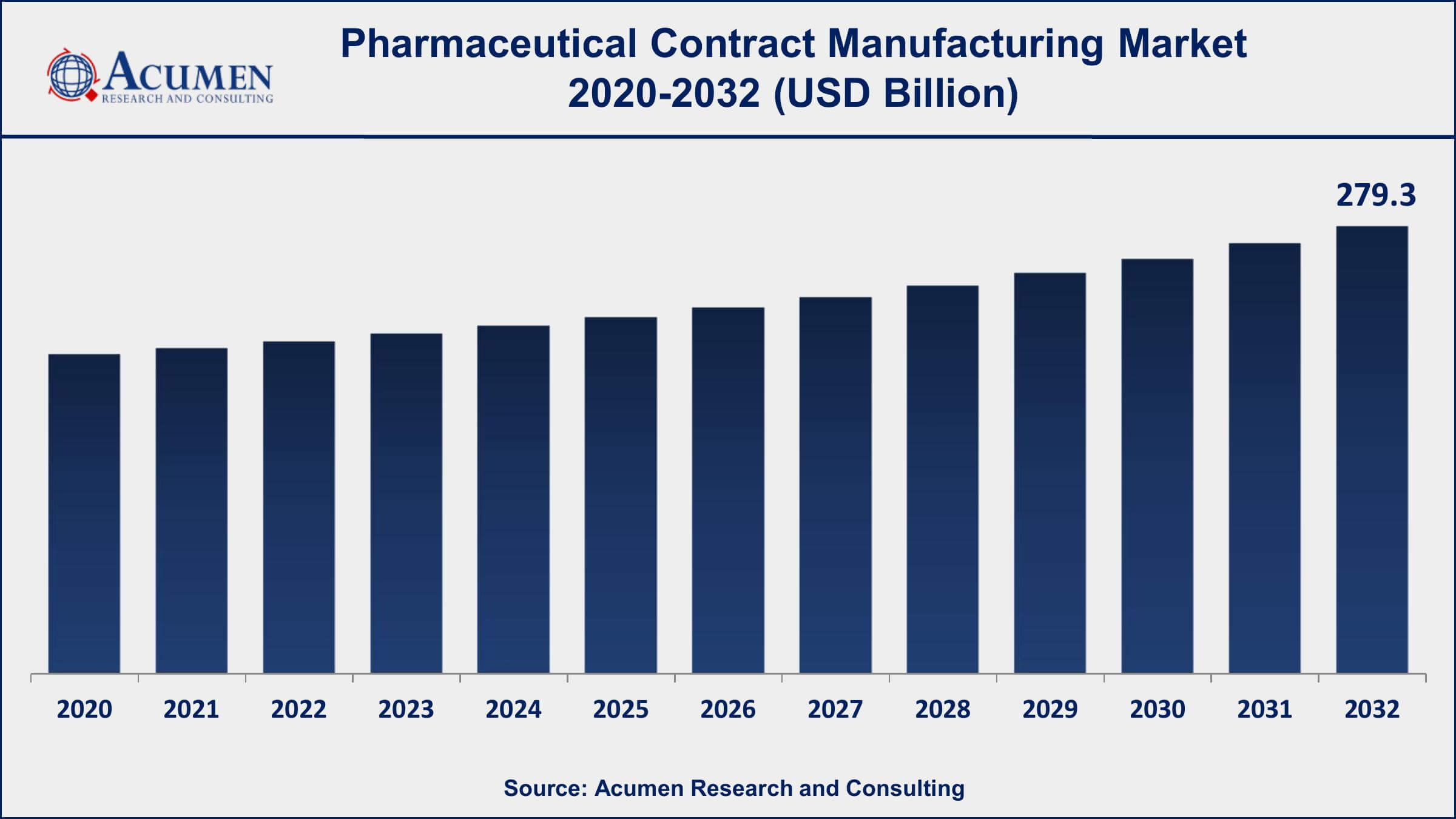

The Global Pharmaceutical Contract Manufacturing Market Size accounted for USD 135.6 Billion in 2022 and is projected to achieve a market size of USD 279.3 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Acumen Research and Consulting is excited to announce the release of its comprehensive report on the Pharmaceutical Contract Manufacturing Market, providing an in-depth analysis of market trends, growth drivers, challenges, and forecasts up to 2032. This report is an essential resource for industry stakeholders, including pharmaceutical companies, contract manufacturers, and investors, looking to navigate and capitalize on the evolving landscape of the pharmaceutical contract manufacturing sector.

Get Quick Access to Sample Pages Now: https://www.acumenresearchandconsulting.com/request-sample/353

Pharmaceutical Contract Manufacturing (PCM) is a type of outsourcing service where a pharmaceutical company hires a contract manufacturing organization (CMO) to produce drugs or drug components on its behalf. PCM allows pharmaceutical companies to save on costs and resources by partnering with specialized CMOs that have the necessary expertise, equipment, and facilities to produce high-quality drugs at a lower cost and faster turnaround time.

Market Overview

The pharmaceutical contract manufacturing market has been witnessing substantial growth, driven by the increasing demand for outsourced manufacturing services, advancements in pharmaceutical technologies, and the rising complexity of drug development processes. As per our latest research, The Global Pharmaceutical Contract Manufacturing Market Size accounted for USD 135.6 Billion in 2022 and is projected to achieve a market size of USD 279.3 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Key Market Drivers

- Rising Demand for Outsourced Manufacturing Services: Pharmaceutical companies are increasingly outsourcing manufacturing processes to contract manufacturers to focus on core competencies, reduce costs, and enhance operational efficiency. This trend is a significant driver of market growth.

- Advancements in Drug Development and Biopharmaceuticals: The rapid advancements in drug development, particularly in biologics and biosimilars, are leading to a higher demand for specialized manufacturing services. Contract manufacturers are increasingly investing in advanced technologies and facilities to support these developments.

- Cost-Effectiveness and Operational Efficiency: Outsourcing manufacturing allows pharmaceutical companies to avoid substantial capital investments in production facilities and equipment, thus achieving cost-effectiveness and operational efficiency.

- Growing Complexity of Drug Formulations: The development of complex drug formulations, including those for personalized medicine and combination therapies, requires specialized manufacturing expertise that contract manufacturers are well-equipped to provide.

- Regulatory and Quality Compliance: Contract manufacturers are adept at navigating the complex regulatory landscape and ensuring compliance with stringent quality standards, which is crucial for pharmaceutical companies seeking to bring their products to market efficiently.

Market Trends

- Increased Focus on Biologics and Biosimilars: The shift towards biologics and biosimilars is a major trend shaping the pharmaceutical contract manufacturing market. Contract manufacturers are investing in state-of-the-art biomanufacturing capabilities to meet the growing demand for these products.

- Rise of Modular and Flexible Manufacturing Facilities: Modular and flexible manufacturing facilities are becoming increasingly popular as they allow contract manufacturers to quickly adapt to changing client needs and new product introductions.

- Integration of Advanced Technologies: The integration of advanced technologies such as artificial intelligence (AI), machine learning, and automation is transforming the pharmaceutical contract manufacturing industry, enhancing production efficiency, and reducing time-to-market.

- Strategic Partnerships and Collaborations: There is a growing trend of strategic partnerships and collaborations between pharmaceutical companies and contract manufacturers to leverage complementary strengths and drive innovation in drug development and production.

- Emphasis on Sustainable Manufacturing Practices: With increasing environmental concerns, there is a notable shift towards sustainable manufacturing practices in the pharmaceutical industry. Contract manufacturers are adopting green technologies and practices to reduce their environmental footprint.

Pharmaceutical Contract Manufacturing Market Segmentation

The global Pharmaceutical Contract Manufacturing market segmentation is based on Services, End-user, and geography.

Pharmaceutical Contract Manufacturing Market By Services

- Pharmaceutical Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Tablet manufacturing services

- Parenteral/injectable manufacturing services

- Capsule manufacturing services

- Semi-solid manufacturing services

- Oral liquid manufacturing services

- Other formulation manufacturing services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Biologics Manufacturing Services

- Biologics FDF Manufacturing Services

- Biologics API Manufacturing Services

- Drug Development Services

Pharmaceutical Contract Manufacturing Market By End-user

- Big Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Small & Medium-sized Pharmaceutical Companies

- Others

𝑮𝒆𝒕 𝒅𝒆𝒕𝒂𝒊𝒍𝒆𝒅 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒔 𝒂𝒏𝒅 𝒔𝒕𝒂𝒚 𝒂𝒉𝒆𝒂𝒅 𝒐𝒇 𝒕𝒉𝒆 𝒄𝒐𝒎𝒑𝒆𝒕𝒊𝒕𝒐𝒓𝒔 @ https://www.acumenresearchandconsulting.com/pharmaceutical-contract-manufacturing-market

Regional Insights

- North America: North America holds a dominant position in the pharmaceutical contract manufacturing market, driven by the presence of major pharmaceutical companies, advanced manufacturing technologies, and a favorable regulatory environment. The U.S. and Canada are key contributors to market growth in this region.

- Europe: Europe is a significant market for pharmaceutical contract manufacturing, with strong demand driven by the region’s well-established pharmaceutical industry and emphasis on regulatory compliance. Countries such as Germany, the UK, and Switzerland are leading the market in Europe.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in the pharmaceutical contract manufacturing market due to increasing healthcare investments, a growing pharmaceutical industry, and cost advantages. China and India are major markets in this region, offering substantial opportunities for growth.

- Latin America: In Latin America, the pharmaceutical contract manufacturing market is expanding, supported by rising healthcare needs and increasing investments in the pharmaceutical sector. Brazil and Mexico are notable markets in this region.

- Middle East and Africa: The Middle East and Africa are emerging markets for pharmaceutical contract manufacturing, with growth driven by improving healthcare infrastructure and increasing demand for pharmaceutical products. Countries such as South Africa and the UAE are contributing to market expansion in this region.

Competitive Landscape

Some of the top pharmaceutical contract manufacturing market companies offered in the professional report includes Lonza Group AG, Catalent, Inc., Thermo Fisher Scientific Inc., Patheon N.V., Evonik Industries AG, AbbVie Contract Manufacturing, Boehringer Ingelheim GmbH, Recipharm AB, Jubilant Life Sciences Limited, and Dr. Reddy’s Laboratories Ltd.

Opportunities and Challenges

Opportunities:

- Expansion into Emerging Markets: The growth of the pharmaceutical industry in emerging markets presents significant opportunities for contract manufacturers to expand their services and capture new market share.

- Investment in Advanced Manufacturing Technologies: Investing in advanced manufacturing technologies and capabilities can enhance production efficiency, attract new clients, and drive innovation in drug development.

- Growing Demand for Personalized Medicine: The increasing focus on personalized medicine and tailored therapies offers opportunities for contract manufacturers to provide specialized services and support the development of customized drug formulations.

Challenges:

- Regulatory Compliance: Navigating the complex and evolving regulatory landscape can be challenging for contract manufacturers, requiring continuous adaptation to meet compliance requirements.

- Supply Chain Disruptions: Ensuring a reliable and uninterrupted supply chain for raw materials and components is crucial for maintaining production schedules and meeting client demands.

- Intellectual Property Concerns: Protecting intellectual property and proprietary technologies is a significant challenge, requiring robust measures to safeguard sensitive information and innovations.

Get a Discount On The Purchase Of This Report @ https://www.acumenresearchandconsulting.com/get-discount/353

Trending Reports:

About Us:

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

Contact Us:

Acumen Research and Consulting

India: +918983225533