Market Overview

Anti-money laundering software market plays a crucial role in detecting, preventing, and reporting money laundering activities. Money laundering, which disguises the illegal origins of financial assets, poses a significant threat to financial systems worldwide. AML software streamlines the prevention process, ensuring that suspicious activities are flagged and investigated. With features like transaction monitoring, customer due diligence (CDD), risk assessment, and regulatory reporting, this software aids in maintaining transparency and legal compliance.

The increasing sophistication of money laundering activities has prompted financial institutions, insurance companies, fintech firms, and other regulated entities to invest heavily in AML software solutions. These technological tools offer automated systems that enhance operational efficiency and significantly reduce manual effort in monitoring financial transactions.

Click here to get a Sample report copy@ https://www.amecoresearch.com/sample/277013

Market Growth Drivers

Several factors are contributing to the rapid growth of the AML software market:

Increasing Regulatory Pressure: Governments and international regulatory bodies are consistently tightening anti-money laundering frameworks to ensure financial integrity. AML software ensures that companies comply with these ever-evolving standards and regulations.

Rising Incidences of Financial Crimes: With increasing cases of fraud, cybercrimes, and terrorism financing, the demand for sophisticated AML software has risen, pushing the market’s growth.

Technological Advancements: The integration of artificial intelligence (AI), machine learning (ML), and big data analytics is transforming AML software by enabling real-time detection of suspicious activities and providing predictive insights.

Growing Digital Transactions: As digital banking and online payment platforms continue to expand, so does the risk of cyber-related financial crimes, leading to greater investment in AML technologies.

Cross-Border Transactions: The globalization of trade and finance has led to an increase in cross-border transactions, complicating AML compliance and driving demand for automated solutions that can manage complex international financial systems.

Key Features of AML Software

Transaction Monitoring: Detects and flags suspicious activities based on transaction patterns and risk factors.

Customer Due Diligence (CDD): Verifies customer identities and assesses their risk levels through risk-based approaches.

Watchlist Screening: Cross-references customers against lists of known criminals, politically exposed persons (PEPs), and sanctioned entities.

Automated Reporting: Generates regulatory reports that meet compliance standards, reducing the manual burden on compliance teams.

Future Outlook and Opportunities

The future of the AML software market looks promising, with several key opportunities on the horizon:

Cloud-Based Solutions: The shift toward cloud-based AML platforms is expected to drive the market further, offering enhanced scalability, flexibility, and lower operational costs.

Integration of AI and Machine Learning: As financial crimes evolve, AML software must become more proactive. AI and ML will empower systems to not only detect patterns but also predict potential threats, improving the overall efficacy of AML tools.

Growing Demand for Real-Time Data Analysis: With the increasing need for immediate detection of fraudulent activities, the demand for real-time AML solutions is set to rise. AML software will likely incorporate more robust data analytics capabilities, providing financial institutions with real-time insights into transaction behaviors.

Blockchain and Cryptocurrency Regulation: The growing use of cryptocurrencies in illicit activities presents both a challenge and an opportunity. AML solutions tailored for cryptocurrency exchanges will likely see significant growth as regulatory bodies strive to keep pace with blockchain technology.

Regional Insights

North America: North America leads the market due to the stringent regulatory frameworks and high adoption of advanced AML software in countries like the U.S. and Canada.

Europe: Europe is expected to witness steady growth, driven by increasing enforcement of anti-money laundering directives by the European Union.

Asia-Pacific: The Asia-Pacific region is projected to grow at the highest CAGR during the forecast period. Rising awareness of money laundering risks and regulatory compliance in countries like China, India, and Japan is fueling market expansion.

To Check Toc: https://www.amecoresearch.com/anti-money-laundering-software-market/toc/277013

Challenges in the AML Software Market

While the market is growing rapidly, several challenges must be addressed:

High Implementation Costs: Despite the benefits, implementing AML software is a costly endeavor, particularly for smaller financial institutions. Initial setup, training, and ongoing maintenance can strain resources.

Evolving Regulatory Requirements: Keeping up with the ever-changing regulations across different jurisdictions is challenging. AML software providers must continuously update their solutions to ensure compliance.

Data Privacy Concerns: With increased data sharing and monitoring, privacy concerns are on the rise. AML software must navigate the balance between compliance and maintaining customer trust.

Strategies for Market Growth

To maintain their competitive edge and continue growing, AML software vendors are employing several strategies:

Product Innovation: Continuous updates and improvements in AML software, such as better AI integration and user-friendly interfaces, will help companies stay relevant.

Collaborations and Partnerships: AML vendors are increasingly collaborating with financial institutions, regulators, and fintech companies to develop holistic solutions.

Geographic Expansion: Expanding into emerging markets, particularly in the Asia-Pacific and Latin America regions, will be critical for growth as financial systems become more complex.

Customer-Centric Solutions: Offering tailored solutions that meet specific industry needs, such as for fintech, insurance, or cryptocurrency platforms, will enhance customer acquisition and retention.

Conclusion

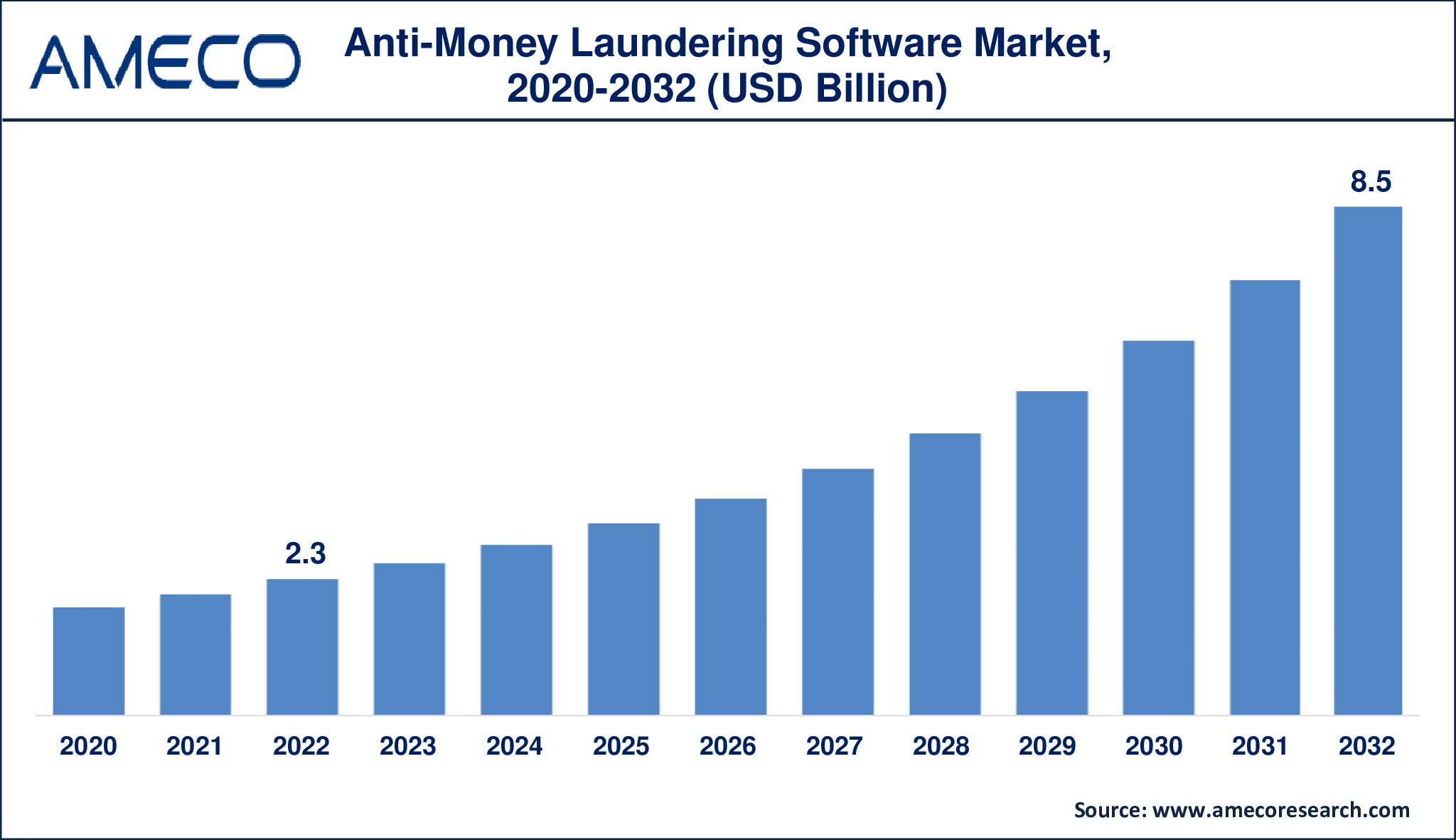

The anti-money laundering software market is set to witness significant growth over the next decade, driven by regulatory pressure, technological advancements, and the increasing complexity of financial crimes. As financial institutions worldwide continue to prioritize compliance and risk management, the demand for advanced AML solutions will only increase. Companies that can offer innovative, scalable, and compliant software solutions will dominate the market by 2032.

MARKET SEGMENTATION:

Anti-Money Laundering Software Market By Component

- Service

- Software

Anti-Money Laundering Software Market By Deployment Type

- Cloud

- On-Premise

Anti-Money Laundering Software Market By Product

- Transaction Monitoring

- Currency Transaction Reporting

- Customer Identity Management

- Compliance Management

- Others (Sanction Screening Software and Case Management Software)

Anti-Money Laundering Software Market By End-Use Industry

- IT and Telecommunications

- Healthcare

- BFSI

- Transportation and Logistics

- Manufacturing

- Defense and Government

- Retail

- Energy and Utilities

- Others

CUSTOMIZED REQUIREMENTS? NEED ANY HELP? PLEASE EMAIL US @ sales@amecoresearch.com

To Purchase this Premium Report@ https://www.amecoresearch.com/buy/277013

About Ameco Research:

The complete information about our alliance publishers and the business verticals they cater to helps us in appropriately responding to our client requirements and identifying the potential opportunities in the market and suggest the research that can best suit client’s requirement. Our comprehensive list of research reports boasts a complete collection of database casing almost every market category and sub-category.

Browse For More Related Reports:

The Global Esports Market Size was valued at USD 1.7 Billion in 2022 and is anticipated to reach USD 15.5 Billion by 2032 with a CAGR of 24.9% from 2023 to 2032.The global Precious Metal Plating Chemicals Market size was valued at US$ 2.3 Billion in 2022 and is anticipated to reach US$ 3.1 Billion by 2032 with a CAGR of 3.3% from 2023 to 2032

For Latest Update Follow Us on Twitter and, LinkedIn

Contact Us:

Mr. Richard Johnson

Ameco Researc

India: +918983225533

E-mail: sales@amecoresearch.com