What is Insurance Telematics?

Insurance telematics market refers to the use of technology to collect and analyze driving data, enabling insurers to track and evaluate driver behavior in real-time. Using devices such as telematics boxes or smartphone apps, insurers can monitor key driving metrics like speed, braking, acceleration, and trip durations, helping them develop personalized insurance premiums. This technology-driven solution is not only enhancing the accuracy of insurance policies but also helping reduce premiums for safe drivers.

Click here to get a Sample report copy@ https://www.amecoresearch.com/sample/277012

Market Drivers and Benefits of Insurance Telematics

Personalized Premiums: Insurance telematics allows for the development of personalized insurance premiums based on a driver’s behavior. Safer drivers receive lower premiums, while high-risk drivers may face higher rates. This system rewards responsible driving and encourages drivers to improve their habits, leading to better road safety overall.

Cost Reduction for Insurers and Consumers: With precise real-time data, insurance companies can more accurately predict risk, reducing the incidence of claims. Consumers benefit through discounted insurance rates and more transparent pricing models.

Encouraging Safer Driving: By providing real-time feedback on driving habits, telematics helps drivers become more aware of their behavior on the road. As a result, many insurance companies incentivize customers with safe driving discounts, reducing accident rates.

Fraud Detection and Claims Management: Telematics data can help detect fraudulent claims by providing accurate information about the circumstances of an accident. This leads to more efficient claims processing and lower costs associated with fraudulent activity.

Environmental Impact: Telematics solutions can also help drivers optimize their routes and driving behavior, leading to reduced fuel consumption and lower emissions. This contributes to more eco-friendly driving habits, aligning with global sustainability goals.

To Check Toc: https://www.amecoresearch.com/insurance-telematics-market/toc/277012

Key Trends and Future Outlook

Rising Adoption of Connected Cars: The rise of connected cars equipped with advanced IoT sensors is expected to fuel the growth of the insurance telematics market. By 2032, almost all new vehicles are anticipated to be connected, which will naturally boost the demand for telematics-based insurance.

Increasing Regulatory Support: Several governments worldwide are supporting the integration of telematics in insurance through regulatory frameworks aimed at improving road safety. For example, the EU’s eCall initiative mandates all new cars in the European Union to be fitted with telematics technology to enable emergency services during accidents.

Growth in Usage-Based Insurance (UBI): The surge in demand for usage-based insurance (UBI) models is another significant factor driving market growth. These models base premiums on actual driving data, allowing insurers to create policies tailored to individual driving patterns.

Technological Innovations: The ongoing advancements in big data analytics, AI, and machine learning are improving the ability to interpret driving data, enhancing risk prediction models, and boosting the efficiency of telematics-based insurance.

Expansion in Emerging Markets: While North America and Europe remain key markets, Asia-Pacific is projected to witness significant growth due to increasing vehicle ownership and the rising awareness of UBI policies. The region is expected to become a pivotal area of expansion for insurance telematics providers by 2032.

Market Challenges

Data Privacy Concerns: As telematics involves continuous monitoring of driver behavior, concerns around data privacy and the security of personal information remain a key challenge for the market. Insurers will need to ensure compliance with data protection regulations and enhance transparency in how they handle sensitive information.

High Initial Costs: The implementation of telematics technology requires a significant initial investment in hardware and software. Insurance companies will need to balance these costs against the potential long-term benefits, such as reduced claims and increased customer retention.

Strategic Recommendations for Market Players

Partnerships and Collaborations: Insurance companies should form strategic partnerships with automobile manufacturers, telematics providers, and technology firms to integrate telematics solutions seamlessly into vehicles. Collaborations with OEMs (Original Equipment Manufacturers) can help reduce costs and improve market penetration.

Focus on Customer Education: Educating customers about the benefits of telematics and the potential for premium discounts is crucial for driving adoption. Companies can also offer trial programs to allow drivers to experience the benefits firsthand.

Leverage AI and Predictive Analytics: To gain a competitive edge, insurers should harness AI and predictive analytics to extract deeper insights from telematics data. This can improve risk assessment accuracy and optimize claims management.

Expand Usage-Based Insurance Products: With the growing consumer interest in usage-based insurance, companies should diversify their product offerings by introducing pay-as-you-drive and pay-how-you-drive insurance plans, which are tailored to individual driving habits.

Conclusion:

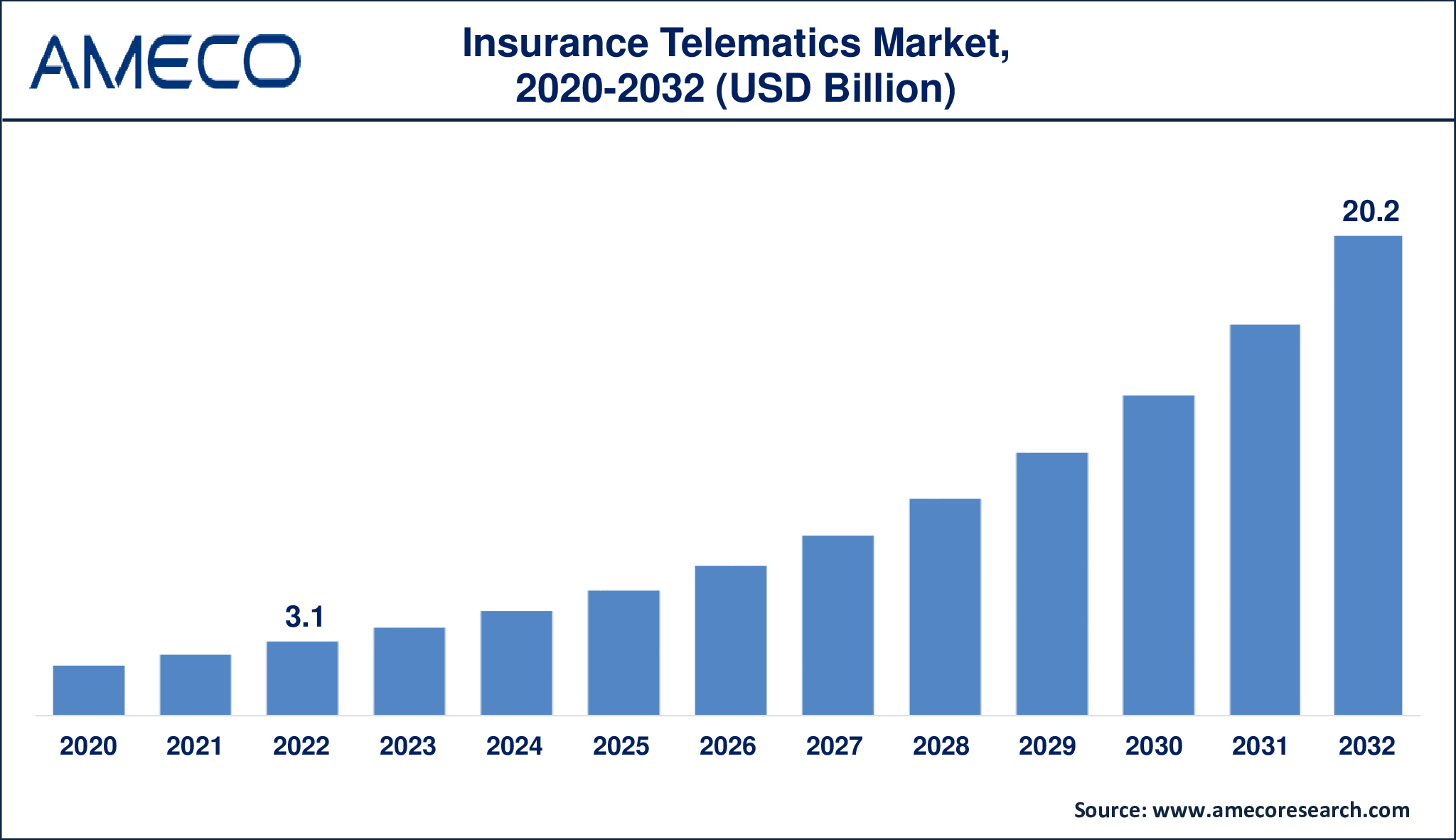

The Global Insurance Telematics Market is on an upward trajectory, driven by the rising adoption of connected car technologies, increasing consumer awareness, and the growing demand for personalized insurance policies. With telematics playing a pivotal role in shaping the future of the automotive insurance industry, insurers who embrace this technology will be better positioned to offer innovative products, reduce operational costs, and provide value to both customers and shareholders.

MARKET SEGMENTATION:

Insurance Telematics Market By Offering

- Hardware

- Software

- Others

Insurance Telematics Market By Technology

- OBD-II

- Smartphone

- Hybrid

- Black-Box

Insurance Telematics Market By Deployment

- On-Premise

- Cloud

Insurance Telematics Market By Size

- Large Enterprises

- Medium and Small Enterprises

CUSTOMIZED REQUIREMENTS? NEED ANY HELP? PLEASE EMAIL US @ sales@amecoresearch.com

To Purchase this Premium Report@ https://www.amecoresearch.com/buy/277012

About Ameco Research:

The complete information about our alliance publishers and the business verticals they cater to helps us in appropriately responding to our client requirements and identifying the potential opportunities in the market and suggest the research that can best suit client’s requirement. Our comprehensive list of research reports boasts a complete collection of database casing almost every market category and sub-category.

Browse For More Related Reports:

The Global Artificial Intelligence in Marketing Market Size was valued at USD 13.9 Billion in 2022 and is anticipated to reach USD 137.2 Billion by 2032 with a CAGR of 26.1% from 2023 to 2032.

The Anime Market Size was valued at USD 26.4 Billion in 2022 and is anticipated to reach USD 62.8 Billion by 2032 with a CAGR of 9.2% from 2023 to 2032.

The Global Influencer Marketing Platform Market Size was valued at USD 11.7 Billion in 2022 and is anticipated to reach USD 192.4 Billion by 2032 with a CAGR of 32.8% from 2023 to 2032.

For Latest Update Follow Us on Twitter and, LinkedIn

Contact Us:

Mr. Richard Johnson

Ameco Research

India: +918983225533

E-mail: sales@amecoresearch.com