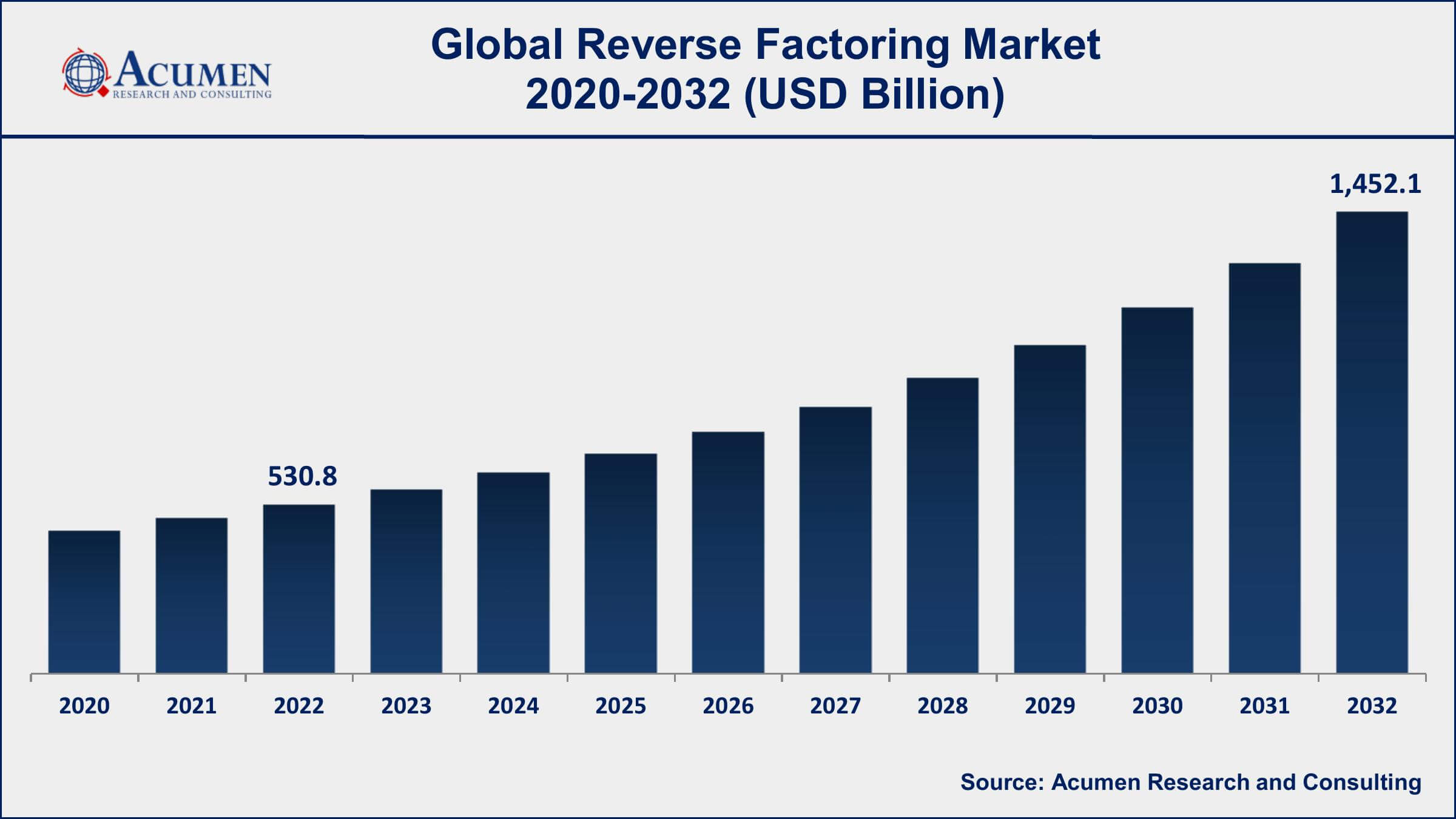

The Global Reverse Factoring Market is projected to experience significant growth over the next decade, with estimates indicating that the market size will reach USD 1,452.1 Billion by 2032. According to a detailed market analysis conducted by Acumen Research And Consulting, the reverse factoring market is expected to expand at a robust compound annual growth rate (CAGR) of 10.8% during the forecast period from 2023 to 2032.

Market Overview

Reverse factoring, also known as supply chain finance, is a financial arrangement that allows companies to optimize their cash flow by enabling suppliers to receive early payments on their invoices. This innovative financing solution has gained traction among businesses seeking to strengthen supplier relationships and enhance working capital management. As organizations increasingly recognize the benefits of reverse factoring, the market is poised for robust expansion.

The Reverse Factoring Market Size accounted for USD 530.8 Billion in 2022 and is projected to achieve a market size of USD 1,452.1 Billion by 2032 growing at a CAGR of 10.8% from 2023 to 2032.

Download Full PDF Sample Copy of Research Report @ https://www.acumenresearchandconsulting.com/request-sample/3426

Key Market Drivers

- Growing Need for Working Capital Management:

Businesses are under constant pressure to optimize their working capital. Reverse factoring provides a solution that allows companies to extend payment terms while ensuring suppliers receive timely payments, thus enhancing cash flow. - Increased Adoption of Financial Technology:

The rise of financial technology (fintech) platforms has facilitated the growth of reverse factoring solutions. These platforms streamline the onboarding process for suppliers and offer real-time visibility into cash flow, making reverse factoring more accessible. - Focus on Supplier Relationship Management:

As businesses strive to improve their supply chain resilience, fostering strong relationships with suppliers has become crucial. Reverse factoring not only improves supplier liquidity but also strengthens partnerships, encouraging loyalty and collaboration. - Market Volatility and Economic Uncertainty:

In times of economic uncertainty, companies are increasingly adopting reverse factoring to mitigate risks associated with supply chain disruptions. By ensuring suppliers have access to funds, businesses can maintain a stable supply chain.

REQUEST A $1000 DISCOUNT ON CREDIT CARD PURCHASE

Market Segmentation

The global Reverse Factoring Market segmentation is based on category, financial institution, end-use, and geography.

Reverse Factoring Market By Category

- International

- Domestic

Reverse Factoring Market By Financial Institution

- Banks

- Non-banking Financial Institutions

Reverse Factoring Market By End-use

- Manufacturing

- Information Technology

- Transport & Logistics

- Construction

- Healthcare

- Others

Region:

-

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Insights

North America:

North America is expected to dominate the reverse factoring market, driven by a mature financial services sector and a high adoption rate of innovative financing solutions. The U.S. market is particularly strong, with numerous fintech companies offering reverse factoring solutions to businesses.

Europe:

Europe is witnessing significant growth in reverse factoring, particularly in the manufacturing and retail sectors. Countries like Germany and the UK are leading the charge, with companies increasingly adopting these solutions to enhance their cash flow and supplier relationships.

Asia-Pacific:

The Asia-Pacific region is emerging as a key player in the reverse factoring market, fueled by rapid industrialization and the increasing adoption of fintech solutions. Countries such as China and India are seeing a growing number of businesses implement reverse factoring to improve working capital management.

Competitive Landscape

The reverse factoring market features a competitive landscape with key players including:

Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH.

These companies are leveraging technology and strategic partnerships to enhance their offerings and capture a larger market share.

Challenges and Restraints

While the outlook for the reverse factoring market is positive, several challenges may impact growth:

- Lack of Awareness:

Many businesses, particularly small and medium-sized enterprises (SMEs), remain unaware of reverse factoring and its benefits, limiting market penetration. - Regulatory Constraints:

Varying regulatory environments across regions can create challenges for financial institutions offering reverse factoring solutions.

Future Outlook

The future of the reverse factoring market is bright, with several key trends expected to shape its trajectory:

- Integration of Advanced Analytics:

The use of data analytics in reverse factoring will enable businesses to make informed decisions regarding cash flow management and supplier selection. - Emergence of Blockchain Technology:

Blockchain technology is set to revolutionize the reverse factoring landscape by enhancing transparency and reducing fraud, thus increasing trust among participants in the supply chain. - Expansion of Global Trade:

As global trade continues to expand, the demand for reverse factoring solutions will increase, allowing businesses to manage cross-border transactions more effectively.

Conclusion

The reverse factoring market is on the cusp of substantial growth over the next decade. Driven by a growing need for working capital management, increased adoption of fintech solutions, and a focus on supplier relationships, the market is expected to reach USD 1,452.1 Billion by 2032 As businesses navigate challenges and seize opportunities, innovation and strategic partnerships will be vital in shaping the future of reverse factoring.

Inquiry before Buying by this Research Report: https://www.acumenresearchandconsulting.com/inquiry-before-buying/3426

More Study:

About Us:

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

Contact Us:

Acumen Research and Consulting

India: +918983225533